Cryptocurrency markets continue to attract traders seeking volatility, flexibility, and diversified trading opportunities. However, direct crypto ownership is not the only way to participate in price movements. Crypto CFDs (Contracts for Difference) allow traders to speculate on cryptocurrency price changes without owning the underlying asset.

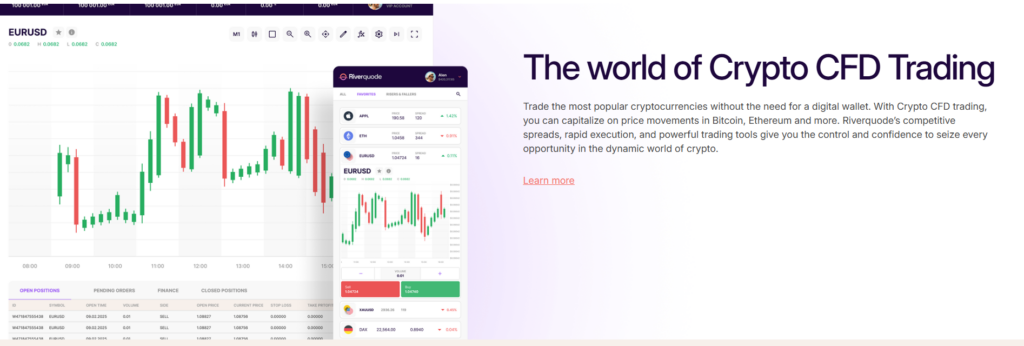

Riverquode offers access to crypto CFD trading through a structured and transparent trading environment designed to support informed decision-making and controlled risk exposure.

This review explores how trading crypto CFDs on Riverquode works, what the platform offers, and why traders consider it a practical option for engaging with the crypto market.

What Are Crypto CFDs and How They Work

Crypto CFDs allow traders to speculate on the price movement of cryptocurrencies such as Bitcoin, Ethereum, and other popular digital assets without holding the coins themselves. Instead of ownership, traders enter contracts that reflect price changes.

Key characteristics of crypto CFD trading include:

- Ability to trade rising and falling markets

- No requirement for crypto wallets

- Access to leverage (depending on account conditions)

- Faster market participation without blockchain transactions

Riverquode integrates crypto CFDs into its broader CFD offering, allowing traders to manage crypto exposure alongside other asset classes within a single platform.

Image source: Riverquode/crypto

Crypto CFD Trading on Riverquode

Riverquode provides access to crypto CFD markets through its web-based trading platform. The platform is designed to support clarity, stability, and efficient execution—important factors when trading volatile crypto assets.

Traders using Riverquode can:

- Monitor crypto price movements in real time

- Execute buy and sell orders based on market conditions

- Manage exposure using structured risk controls

- Trade crypto CFDs without holding digital assets

This approach allows traders to focus on market behavior rather than technical aspects such as custody or blockchain transfers.

Platform Design and Trading Experience

Crypto markets can move rapidly, making platform reliability and clarity essential. Riverquode’s trading interface presents market data in a clean and structured format, helping traders avoid unnecessary distractions.

Platform features supporting crypto CFD trading include:

- Clear price charts and market data

- Stable execution during active sessions

- Simple navigation between instruments

- Tools for monitoring open positions and exposure

By reducing complexity, Riverquode helps traders focus on analysis and execution rather than platform navigation.

Risk Management in Crypto CFD Trading

Volatility is a defining characteristic of cryptocurrency markets. Trading crypto CFDs requires careful risk management, especially when leverage is involved.

Riverquode supports responsible trading behavior by allowing traders to:

- Monitor exposure clearly

- Apply stop-loss and take-profit strategies

- Adjust position sizing based on account balance

- Maintain discipline during high-volatility periods

Rather than promoting aggressive speculation, the platform structure encourages measured and controlled participation.

Execution and Pricing Transparency

Execution reliability and pricing transparency are essential when trading crypto CFDs. Delayed pricing or unstable execution can lead to poor trade outcomes, particularly in fast-moving markets.

Riverquode emphasizes:

- Continuously updated pricing

- Predictable order execution behavior

- Transparent market access without hidden complexity

These factors help traders evaluate whether outcomes are driven by strategy rather than technical uncertainty.

Who Is Crypto CFD Trading on Riverquode Suitable For?

Trading crypto CFDs on Riverquode may appeal to:

- Traders seeking crypto market exposure without asset ownership

- CFD traders looking to diversify beyond forex and indices

- Traders who prefer structured platforms over speculative environments

- Individuals focused on risk-managed crypto participation

The platform’s design supports both developing and experienced traders who value control and clarity.

Crypto CFDs vs Direct Crypto Trading

Compared to direct cryptocurrency ownership, crypto CFDs on Riverquode offer:

- No wallet or custody requirements

- Faster execution without blockchain delays

F - The ability to trade both rising and falling markets

- Integrated risk management tools

However, as with all CFDs, traders should understand that leverage increases both potential gains and losses.

Final Review: Trading Crypto CFDs on Riverquode

Trading crypto CFDs on Riverquode offers a structured way to engage with cryptocurrency price movements without the complexity of direct ownership. The platform focuses on transparency, execution stability, and clear market access—key elements for navigating volatile crypto conditions.

Rather than positioning crypto trading as speculative hype, Riverquode provides an environment designed for disciplined participation and informed decision-making. For traders seeking controlled exposure to crypto markets within a CFD framework, Riverquode presents a practical and professional trading solution.